How to Get a Free EIN for Your Arizona LLC – Guide

We understand that dealing with the IRS can be daunting, but obtaining an EIN for your LLC doesn’t have to be overwhelming.

This page will explain an EIN and offer step-by-step instructions for obtaining a free EIN for your Arizona LLC.

What is an EIN Number?

EIN stands for Employer Identification Number, assigned to your LLC by the IRS, a federal agency.

The EIN identifies your business to the IRS, similar to how a Social Security Number identifies an individual. You can also think of the EIN as your account number with the IRS.

✎ Note:

An EIN is not issued by the Arizona Corporation Commission. It is solely issued by the IRS.

EIN Synonyms

Your EIN may be referred to in several different ways, but they all mean the same thing.

Other terms for an EIN include:

- EIN Number

- Employer Identification Number

- Federal Employer Identification Number (FEIN)

- Federal Tax ID Number

- Arizona Federal Tax ID Number

- Federal Tax Identification Number

✎ Note:

An EIN is different from an Arizona Tax ID Number (or state tax ID number). The EIN is issued by the IRS, whereas the Arizona Tax ID Number is issued by the Arizona Department of Revenue.

What is an EIN used for?

An EIN is used by various government agencies to identify your LLC.

Having an EIN for your Arizona Limited Liability Company allows you to:

- Open a business bank account

- File federal, state, and local tax returns

- File Arizona income tax

- Register for Arizona sales tax

- Obtain business lines of credit or loans

- Get a business credit card

- Apply for business licenses or permits

- Manage employee payroll (if applicable)

How much does it cost to get an EIN?

Applying for an EIN for your Arizona LLC is completely free. The IRS does not charge any fees for the online application.

When is the right time to get an EIN?

Only apply for an EIN after your Arizona LLC has been approved.

★ Tip:

If you applied for an EIN before your LLC was approved or made another error, please refer to our FAQs below. We explain how to correct the most common EIN mistakes.

How can I file an EIN application for my Arizona LLC?

✏️ Important:

Before applying for an EIN, confirm the number of LLC members. If you change from a Single-Member LLC to a Multi-Member LLC (or vice versa), you'll need to file paperwork with the IRS and the state. You will also need to transfer LLC ownership, update your Operating Agreement, and notify your accountant, as this will affect your tax filing.

✎ Note:

An LLC stands for Limited Liability Company, not Limited Liability Corporation.

Apply for an EIN (US Citizens and US Residents)

We recommend applying for an EIN online if you possess a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

This is the fastest way to get approved and is also the easiest submitting option. After completing the online application, which takes about 15 minutes, your EIN will be issued right away.

✎ Note:

You can apply for an EIN by mail or fax, but these methods are significantly slower than online filing. We suggest using mail or fax only if you receive an error message (known as an EIN reference number) and are directed by the IRS to use these methods.

Apply for an EIN (Non-US residents)

If you’re a non-US resident without an SSN or ITIN, you can still obtain an EIN for your Arizona LLC. However, you will need to apply by mail or fax, as online applications are not available for you.

Instead, you'll need to mail or fax Form SS-4 to the IRS. This form is used to apply for an EIN.

✎ Note:

It is wrong if you have been advised that you have to appoint a third-party designee. You don't need a third party to file for your EIN on your own.

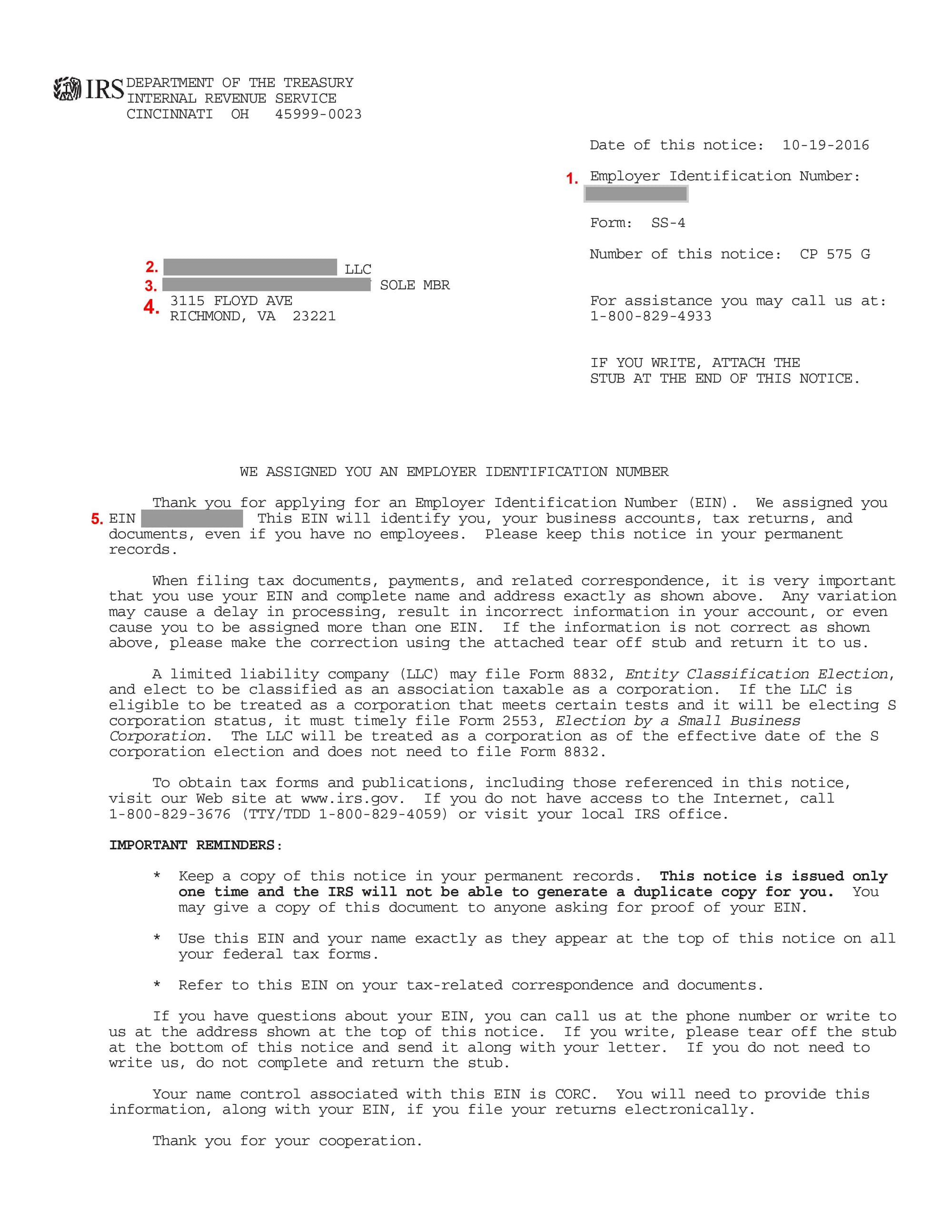

EIN Approval (EIN Confirmation Letter)

Once the IRS issues an EIN for your Arizona LLC, you will receive an official approval letter called the EIN Confirmation Letter (CP 575).

The method you use to apply for an EIN affects how you receive your EIN Confirmation Letter. You can download the EIN Confirmation Letter right away if you apply online. The IRS will mail your EIN Confirmation Letter if you apply by mail or fax using Form SS-4.

Here is what the EIN Confirmation Letter looks like:

LLC Business Bank Account

After getting your EIN, you can establish a business bank account for your Arizona LLC. The bank will need your EIN Confirmation Letter (or EIN Verification Letter) to open the account.

Make sure you compare the offerings of several banks to ensure you select the best banking option. Take into account factors including account fees, transaction limits, and accessible services like online banking. You may maintain a clear division between personal and business activities and handle LLC finances more effectively by opening a separate business account.

Exclusive Offer!

Hire a Northwest Registered Agent to form your LLC for just $39 plus the state fee and receive a free year of Registered Agent service.

(Why is Northwest the best? Read our Northwest Registered Agent review)

Internal Revenue Service (IRS) Contact Information

If you have any questions, you can get in touch with the IRS at 1 800 829 4933. If you have any questions, you can contact me at 1-800-829-4933, Monday through Friday, from 7 am to 7 pm.

To speak with a live representative, follow these steps:

- Press 1 for English.

- Press 1 for Employer Identification Numbers.

- Press 3 for assistance with an existing EIN if you've forgotten it or need other related help.

✎ Note:

Pressing option 3 is the only way to get a live representative.

We advise calling the IRS as soon as they open to avoid long wait times.

The IRS does not provide legal assistance, legal guidance, or tax advice, but it can help with questions about the EIN application process.

Frequently Asked Questions

Does a Single-Member LLC need an EIN?

You may have seen other articles online say that Single-Member LLCs don’t need an EIN. While this is technically true, it’s bad advice.

Having an EIN can protect you from identity theft, and you’ll need an EIN for other purposes – not just filing taxes. Your Arizona LLC needs an EIN to:

- Create a bank account for your business

- Submit your local, state, and federal taxes

- Obtain loans or credit lines for businesses.

- Register for sales taxes

- Apply for business licenses or permits

- Handle payroll for employees (if applicable)

Plus, getting an EIN is free and takes just 10 minutes online. Said another way, we strongly recommend getting an EIN for your Single-Member LLC.

Does a Multi-Member LLC need an EIN?

Yes, all Multi-Member LLCs are required to get an EIN from the IRS. This is because it's required by the Internal Revenue Code.

Do I need an EIN for my DBA?

No. A DBA can't have an EIN. Remember, a DBA is just a nickname for a business or a person. However, the business or person that owns the DBA may need an EIN. The rules depend on the type of business structure you have.

DBA owned by an LLC: If you have an LLC, your LLC needs its own EIN. If your LLC has a DBA, don't get an EIN for the DBA. The DBA is just a nickname for your LLC, and the IRS doesn't recognize DBAs.

DBA owned by the individual: If you registered a DBA, but didn’t form a legal entity (like an LLC), then you're operating a Sole Proprietorship (1 owner) or a General Partnership (2 or more owners).

Sole Proprietorship: Your Arizona Sole Proprietorship (with or without a DBA) isn’t required to have an EIN, but it’s optional.

General Partnership: Your Arizona General Partnership (with or without a DBA) must get an EIN. It's required by the IRS.

Again, in both cases, the DBA itself doesn't get the EIN. It’s the underlying business entity that gets the EIN.

Do I need an EIN for an LLC with no employees?

Yes, you should still get an EIN for your Arizona business even if you don't hire employees. Even though it's called an Employer Identification Number, it doesn't mean you have to have employees. Again, the EIN Number is just a way for the IRS to identify your business.

How should a husband and wife LLC get an EIN?

In most states, husband and wife LLCs can only be treated as a Multi-Member LLC taxed as a Partnership.

However, in community property states, married couples can choose between:

- Husband and wife LLC taxed as a Partnership

- Husband and wife LLC taxed as a Single-Member LLC (aka Qualified Joint Venture)

Arizona is not a community property state. So Arizona husband and wife LLCs can't choose to be taxed as a Qualified Joint Venture (Single-Member LLC).

How you complete your EIN application determines the LLC's tax status. For more information, please see Husband and Wife LLC (Qualified Joint Venture).