Kentucky LLC Annual Report Guidelines

All Kentucky LLCs doing business in the state must file an Annual Report annually.

You must file an annual report to maintain your LLC's compliance with the state and good standing.

You can submit your LLC's Annual Report either by mail or online. We recommend online filing for its convenience and faster processing time.

Below, you'll find instructions for mailing your report and filing online.

Kentucky LLC Annual Report Fee

The filing fee is for both mail and online submissions.

Processing Times

When filing by mail, processing time can vary from 1 day to over a week, depending on the workload of the Secretary of State's office. Kentucky does not provide official processing times for mailed Annual Reports.

They are filing online results in immediate processing.

What is the due date for a Kentucky LLC Annual Report?

Your Kentucky LLC Annual Report is due each year between January 1 and June 30.

The first report is due the year after your Kentucky LLC is approved.

Example 1: If your LLC was approved on February 10, 2024, your first Annual Report will be due between January 1 and June 30, 2025.

Example 2: If your LLC was approved on December 10, 2024, your first Annual Report will be due between January 1 and June 30, 2025.

In other words, no matter when your LLC is approved within a given year, the first Annual Report will be due the following year.

Exclusive Offer!

Hire a Northwest Registered Agent to form your LLC for just $39 plus the state fee and receive a free year of Registered Agent service.

(Why is Northwest the best? Read our Northwest Registered Agent review)

Penalty

If you miss the June 30th deadline for filing your Annual Report, the state may administratively dissolve your LLC. To prevent any issues, we suggest filing early in the year.

How early can it be filed?

January 1st.

Reminders

Between January and February, the Secretary of State will send a postcard to the principal office address of your LLC.

Annual Report is free ($0) for veterans

The "Boots to Business" program, which began on August 1, 2018, allows LLCs that are at least 51% owned by honorably discharged veterans or active duty military members to waive the $15 Annual Report fee for the first 4 years.

When filing your Annual Report by mail, look for the checkbox labeled "veteran-owned."

To have the fee waived for filing your Annual Report online, your LLC must be formed and designated as veteran-owned at the time you filed your Articles of Organization. This ensures your LLC is already listed in the state’s system under the program, and the fee will be shown as $0 online. If your LLC was not designated as veteran-owned when it was formed, you should file the Annual Report by mail to have the fee waived.

Exclusive Offer!

Hire a Northwest Registered Agent to form your LLC for just $39 plus the state fee and receive a free year of Registered Agent service.

(Why is Northwest the best? Read our Northwest Registered Agent review)

How to File Your Kentucky LLC Annual Report by Mail

You can file your Kentucky LLC Annual Report by mail in 2 ways:

- The first option is to fill out the postcard sent by the Secretary of State to update your LLC's member or manager information, then mail it back to the state.

- The second option is to download and print your Annual Report form from the state’s website and mail it in.

If you choose to file by mail, be sure to send it well before the June 30th deadline to allow for delivery time.

Filing Postcard by Mail

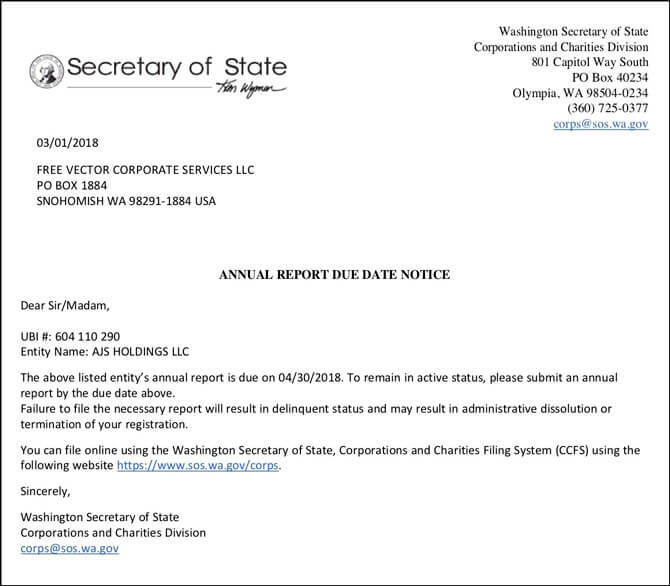

The state will send postcards between January and February each year. Here’s an example of what the postcard looks like:

List the names and addresses of your members or managers on the provided lines. Make any necessary updates, such as deleting former members or managers and adding new ones.

Sign your name, enter your title (e.g., "Member"), and include today's date on the designated lines.

Payment and Mailing Instructions:

Prepare a check or money order for $15, made payable to "Kentucky State Treasurer."

Send your payment and completed postcard to:

Secretary of State

PO Box 1150

Frankfort, KY 40602

Processing Time and Verification:

When filing by mail, the state does not provide a receipt or confirmation of your Annual Report's processing. To ensure everything is in order, we suggest filing online and saving a copy of your filed Annual Report for your records.

To do this, search for your LLC name here, click on your LLC's name, scroll down to "Show Images," select "Annual Report," and then download or save a copy to your computer.

Printing your Annual Report Form and Filing by Mail

Visit the FastTrack Business Organization Search page

Kentucky Secretary of State: Business Entity Search

Search your LLC

Enter the full name or ID number of your Kentucky LLC in the search box, omitting the designator "LLC" or "L.L.C.". Click "Search" and then select your LLC's name from the search results.

Download the Form

On the next page, hover over "Printable Forms" at the top left, then click "Annual Report" to download the form.

Members and Managers Information

If you need to update the member or manager information before filing, either cross out the names of those who are no longer with the LLC or add any new members or managers.

Signature

Enter your name, title (e.g., "Member"), and today's date in the appropriate fields.

Payment and Mailing Instructions:

Prepare a check or money order for $15, payable to "Kentucky State Treasurer."

Mail your payment along with the completed Annual Report form to:

Secretary of State

PO Box 1150

Frankfort, KY 40602

Processing Time and Verification:

When filing by mail, the state won’t send a receipt or confirmation of your Annual Report's processing. To ensure your filing was received, we recommend checking online and saving a copy of your filed Annual Report.

To verify your filing, search for your LLC name here, select your LLC from the search results, scroll to "Images available online," click on "Annual Report," and then download or save a copy to your computer.

Instructions for Filing Kentucky Annual Report Online

Visit the Kentucky Secretary of State Annual Report Filing page:

Kentucky Secretary of State: Annual Report Filing Entity Selection

Search your LLC

Enter your Kentucky LLC's full name or ID number in the search box, omitting "LLC" or "L.L.C." Click on your LLC’s name from the search results.

LLCs Principal Office Address and Registered Agent

A page will display your LLC's principal office address and Registered Agent's details. Review this information, then click "Continue to file an annual report."

Members and Managers Information

Update your Kentucky LLC's member or manager information by adjusting their titles, names, or addresses in the drop-down menus as necessary. Then click "Continue to signatures."

Signature

Enter your name, title (e.g., "Member"), and email address, then click "Confirm this filing."

Review

Review the details in your Kentucky LLC's Annual Report, make any necessary changes, then click "Pay for and complete filing."

Payment Method

Click "Pay using Credit Card or EFT," select your payment method on the following page, enter your billing details, and click "Next." Finally, click "Submit filing" to complete your Annual Report submission and payment.

Processing Time and Verification:

After your Annual Report is processed, you'll receive an email confirmation with a receipt. You will need to visit the website to download a copy of the filed Annual Report.

To download a copy of your filed Annual Report, search for your LLC name here, click on your LLC's name, scroll down to "Images available online," select "Annual Report," and then download and save a copy to your computer.

Need to save time?

Consider hiring a professional to set up your LLC: Northwest Registered Agent offers LLC formation services starting at $39 plus the state fee.

(Find out why Northwest is the top choice for LLC formation)

Kentucky Secretary of State Contact Info

For any questions, you can reach out to the Kentucky Secretary of State at 502-564-3490.