How to Get a Free EIN for Your Pennsylvania LLC – Guide

We understand that dealing with the IRS can be daunting, but obtaining an EIN for your LLC doesn’t have to be overwhelming.

This page will explain an EIN and offer step-by-step instructions for obtaining a free EIN for your Pennsylvania LLC.

What is an EIN Number?

EIN stands for Employer Identification Number, assigned to your LLC by the IRS, a federal agency.

The EIN identifies your business to the IRS, similar to how a Social Security Number identifies an individual. You can also think of the EIN as your account number with the IRS.

✎ Note:

An EIN is not issued by the Pennsylvania Department of State. It is solely issued by the IRS.

EIN Synonyms

Your EIN may be referred to in several different ways, but they all mean the same thing.

Other terms for an EIN include:

- EIN Number

- Employer Identification Number

- Federal Employer Identification Number (FEIN)

- Federal Tax ID Number

- Pennsylvania Federal Tax ID Number

- Federal Tax Identification Number

✎ Note:

An EIN is different from a Pennsylvania Tax ID Number (or state tax ID number). The EIN is issued by the IRS, whereas the Pennsylvania Tax ID Number is issued by the Pennsylvania Department of Revenue.

What is an EIN used for?

An EIN is used by various government agencies to identify your LLC.

Having an EIN for your Pennsylvania Limited Liability Company allows you to:

- Open a business bank account

- File federal, state, and local tax returns

- File Pennsylvania income tax

- Register for Pennsylvania sales tax

- Obtain business lines of credit or loans

- Get a business credit card

- Apply for business licenses or permits

- Manage employee payroll (if applicable)

How much does it cost to get an EIN?

Applying for an EIN for your Pennsylvania LLC is completely free. The IRS does not charge any fees for the online application.

When is the right time to get an EIN?

Only apply for an EIN after your Pennsylvania LLC has been approved.

★ Tip:

If you applied for an EIN before your LLC was approved or made another error, please refer to our FAQs below. We explain how to correct the most common EIN mistakes.

How can I file an EIN application for my Pennsylvania LLC?

✏️ Important:

Before applying for an EIN, confirm the number of LLC members. If you change from a Single-Member LLC to a Multi-Member LLC (or vice versa), you'll need to file paperwork with the IRS and the state. You will also need to transfer LLC ownership, update your Operating Agreement, and notify your accountant, as this will affect your tax filing.

✎ Note:

An LLC stands for Limited Liability Company, not Limited Liability Corporation.

Apply for an EIN (US Citizens and US Residents)

We recommend applying for an EIN online if you possess a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

This is the simplest filing method and offers the quickest approval. Your EIN will be issued immediately upon completing the online application, which takes approximately 15 minutes.

✎ Note:

You can apply for an EIN by mail or fax, but these methods are significantly slower than online filing. We suggest using mail or fax only if you receive an error message (known as an EIN reference number) and are directed by the IRS to use these methods.

Apply for an EIN (Non-US residents)

If you’re a non-US resident without an SSN or ITIN, you can still obtain an EIN for your Pennsylvania LLC. However, you will need to apply by mail or fax, as online applications are not available for you.

Instead, you'll need to mail or fax Form SS-4 to the IRS. This form is used to apply for an EIN.

✎ Note:

If you’ve been told that you must hire a third-party designee, that’s incorrect. You can apply for your EIN independently without needing a third party.

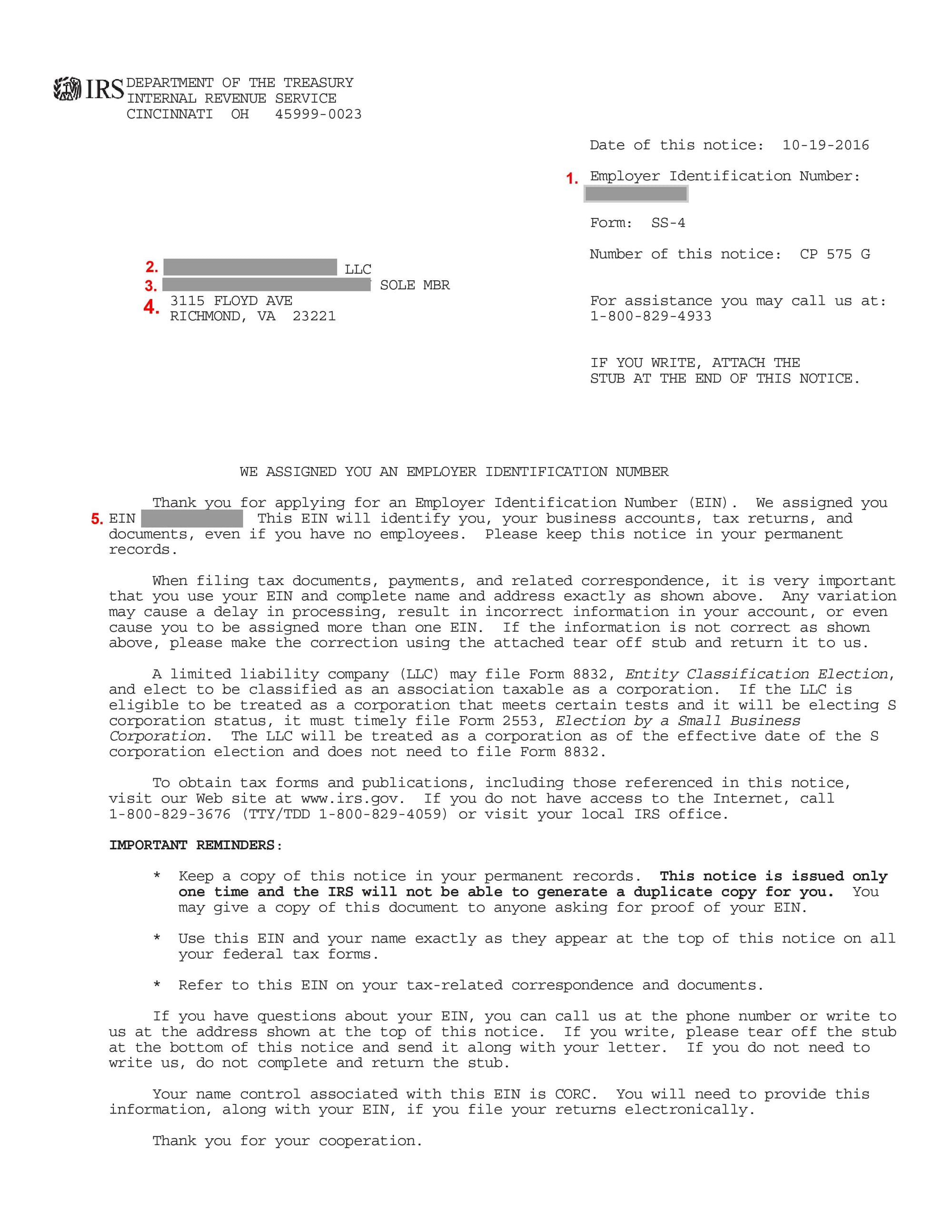

EIN Approval (EIN Confirmation Letter)

Once the IRS issues an EIN for your Pennsylvania LLC, you will receive an official approval letter called the EIN Confirmation Letter (CP 575).

The method you use to apply for an EIN affects how you receive your EIN Confirmation Letter. If you apply online, you can download the EIN Confirmation Letter immediately. If you apply by mail or fax using Form SS-4, the IRS will send your EIN Confirmation Letter by mail.

Here is what the EIN Confirmation Letter looks like:

LLC Business Bank Account

After getting your EIN, you can establish a business bank account for your Pennsylvania LLC. The bank will need your EIN Confirmation Letter (or EIN Verification Letter) to open the account.

To ensure you select the best banking option, compare various banks and their offerings. Look at factors such as account fees, transaction limits, and available features like online banking. Having a dedicated business account will help you manage your LLC's finances more efficiently and keep personal and business transactions separate.

Exclusive Offer!

Hire a Northwest Registered Agent to form your LLC for just $39 plus the state fee and receive a free year of Registered Agent service.

(Why is Northwest the best? Read our Northwest Registered Agent review)

Internal Revenue Service (IRS) Contact Information

If you have any questions, you can contact the IRS at 1-800-829-4933. Their office hours are Monday through Friday, from 7 am to 7 pm.

To speak with a live representative, follow these steps:

- Press 1 for English.

- Press 1 for Employer Identification Numbers.

- Press 3 for assistance with an existing EIN if you've forgotten it or need other related help.

✎ Note:

Pressing option 3 is the only way to get a live representative.

We advise calling the IRS as soon as they open to avoid long wait times.

The IRS does not provide legal assistance, legal guidance, or tax advice, but it can help with questions about the EIN application process.

Frequently Asked Questions

Does a Single-Member LLC need an EIN?

You may have seen other articles online say that Single-Member LLCs don’t need an EIN. While this is technically true, it’s bad advice.

Having an EIN can protect you from identity theft, and you’ll need an EIN for other purposes – not just filing taxes. Your Pennsylvania LLC needs an EIN to:

- Open an LLC business bank account

- Obtain business lines of credit or business loans

- Get a business credit card

- Register for sales taxes

- Apply for business licenses or permits

- Handle employee payroll (if applicable)

Plus, getting an EIN is free and takes just 10 minutes online. Said another way, we strongly recommend getting an EIN for your Single-Member LLC.

Does a Multi-Member LLC need an EIN?

Yes, all Multi-Member LLCs are required to get an EIN from the IRS. This is because it's required by the Internal Revenue Code.

Do I need an EIN for my DBA?

No. A DBA can't have an EIN. Remember, a DBA is just a nickname for a business or a person. However, the business or person that owns the DBA may need an EIN. The rules depend on the type of business structure you have.

DBA owned by an LLC: If you have an LLC, your LLC needs its own EIN. If your LLC has a DBA, don't get an EIN for the DBA. The DBA is just a nickname for your LLC, and the IRS doesn't recognize DBAs.

DBA owned by the individual: If you registered a DBA, but didn’t form a legal entity (like an LLC), then you're operating a Sole Proprietorship (1 owner) or a General Partnership (2 or more owners).

Sole Proprietorship: Your Pennsylvania Sole Proprietorship (with or without a DBA) isn’t required to have an EIN, but it’s optional.

General Partnership: Your Pennsylvania General Partnership (with or without a DBA) must get an EIN. It's required by the IRS.

Again, in both cases, the DBA itself doesn't get the EIN. It’s the underlying business entity that gets the EIN.

Do I need an EIN for an LLC with no employees?

Yes, you should still get an EIN for your Pennsylvania business even if you don't hire employees. Even though it's called an Employer Identification Number, it doesn't mean you have to have employees. Again, the EIN Number is just a way for the IRS to identify your business.

How should a husband and wife LLC get an EIN?

In most states, husband and wife LLCs can only be treated as a Multi-Member LLC taxed as a Partnership.

However, in community property states, married couples can choose between:

- Husband and wife LLC taxed as a Partnership

- Husband and wife LLC taxed as a Single-Member LLC (aka Qualified Joint Venture)

Pennsylvania is not a community property state. So Pennsylvania husband and wife LLCs can't choose to be taxed as a Qualified Joint Venture (Single-Member LLC).

How you complete your EIN application determines the LLC's tax status. For more information, please see Husband and Wife LLC (Qualified Joint Venture).